NEW TO THE SITE - UPDATES

NOTICE: AS DESCRIBED MORE FULLY ON THE WELCOME AND DISCLAIMER PAGE, INFORMATION ON THIS SITE MAY BE ADDED TO, CHANGED, OR DELETED WITHOUT NOTICE. WE SIMPLY CANNOT NOTIFY EVERYONE OF EACH "EDIT," SO YOU ARE URGED TO PRINT OUT EACH PAGE AND COMPARE IT WITH YOUR LAST VISIT TO THE SITE. NONETHELESS, WE WILL ATTEMPT TO HIGHLIGHT ON THIS PAGE WHAT WE BELIEVE TO BE SIGNIFICANT UPDATES. While we will make every effort to keep you up to date with respect to new developments with respect to the Meritor case, this site is maintained by volunteers. WE URGE YOU TO CONSULT WITH COUNSEL AND CONDUCT YOUR OWN INDEPENDENT RESEARCH.

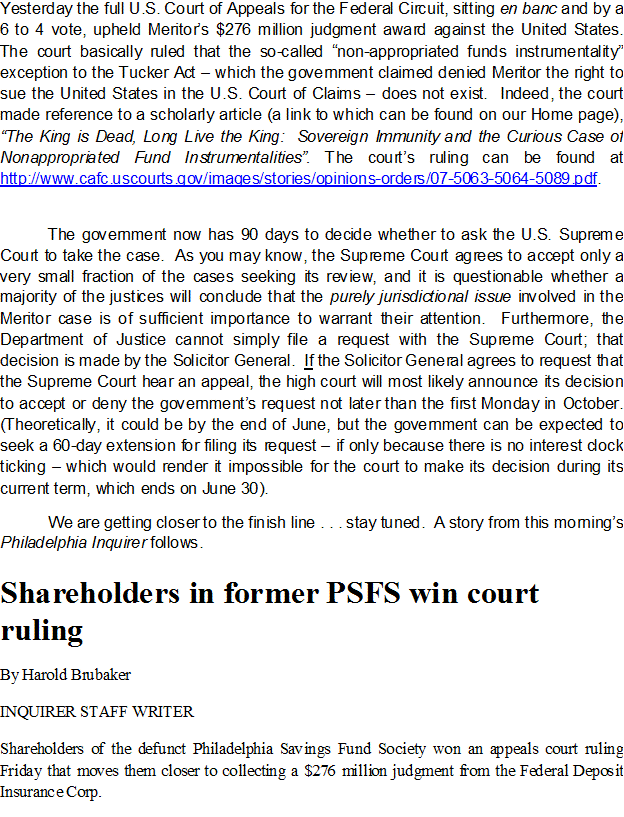

Updated Friday, June 24, 2011 at 3 p.m.

The office of the Solicitor General informed our attorneys this morning that the government has decided not to seek Supreme Court review on Monday. As a result, the en banc decision of the Court of Appeals upholding the $276 million judgment award to Meritor stands and the case has been remanded back to the trial court for further proceedings. Those further proceedings will include a number of housekeeping issues, such as the entry of a Final Order of judgment; motions to reimburse Mr. Slattery and others for the legal and professional fees they advanced over the years; the possible establishment of a small reserve for future claims, etc. We will be working closely with the Receiver in the ensuing weeks with a view towards having distributions made to sharerholders at the earliest possible date.

We have heard from many shareholders today who have asked us, on behalf of all of their fellow shareholders, to express their thanks and gratitude to Frank Slattery and Gary Hindes for all they have done over these past 19 years on behalf of all of us. Especial thanks goes to Mr. Slattery, who, while serving on the PSFS board of directors, fought the FDIC's illegal attempts to close the bank and then, when that failed, fearlessly brought the lawsuit, financed it primarily out of his own pocket, and -- despite many, many setbacks -- never, ever, gave up. In this era of widespread cynicism and polarized politics, let no one belittle the ages-old belief that "one man can make a difference". Mr. Slattery expemplifies that that is still true today (and may it always be).

Updated May 22, 2011

The government has been granted an extension until June 27 to decide whether it wants to petition the Supreme Court to take an appeal.

Updated January 29, 2011

Updated July 8, 2010

Oral argument was held this morning in front of all nine active judges of the U.S. Court of Appeals for the Federal Circuit. One judge seemed unimpressed with the government's position while another seemed to agree with it. Of the other seven judges, four asked many questions, mostly involving the intracacies of the NAFI doctrine, while three had nothing to say. All in all, Mr. Slattery's attorneys were quite pleased by the questions that were asked and with how the hearing went.

At this point, we have no idea when the court will hand down its ruling, as there is no deadline. We will, of course, update the site when it is issued.

Updated June 16, 2010

In anticipation of the oral arguments to take place on July 8, we are publishing all of the legal briefs which have now been filed. As you will read, some of the arguments are highly technical and fairly arcane. Here they are, in the order of their filing:

Opening Brief of the United States:

Gov_t_opening_en_banc_brief.pdf

Brief of the FDIC as amicus curiae:

En_banc_amicus_brief_FDIC.pdf

Brief of Intervenor:

Roth_En_Banc_Brief.pdf

Brief of Mr. Slattery on behalf of Meritor:

Slattery_En_Banc_Brief.pdf

Closing brief of the United States

FDIC_Reply_En_Banc_brief__FINAL_.pdf

As we always do, we urge you to read all of the briefs, consult with your own professsional advisors, and come to your own conclusions. Nevertheless, we are very encouraged by the arguments Mr. Slattery's attorneys have raised. To summarize: first, under existing legal precedent, the FDIC is not a NAFI (Non-Appropriated Funds Instrumentality) and thus it can be sued in the Court of Claims. This position was upheld both by the trial court and by the original panel decision of the court of appeals. Second, by waiting until after the trial had ended (but before a judgment against it could be handed down) to raise the NAFI objection (a trial which very clearly had gone against the government), the government waived the claim as to the Meritor case. Finally -- and this is perhaps the most interesting argument and which has very far-reaching implications beyond the Meritor case -- Mr. Slattery's attorneys challenge the very validity of the NAFI doctrine itself, calling it 'judge-made law'. (They were unable to raise this argument earlier in the proceedings, as the NAFI doctrine can be reversed only by the full Court of Appeals for the Federal Circuit, sitting en banc, or by the U.S. Supreme Court itself). For those of you interested in knowing more about the NAFI doctrine, we refer you to the various updates below as well as to "The King is Dead, Long Live the King! The Curious Case of Nonappropriated Fund Instrumentalities".

Updated April 6, 2010

The clerk of the court has notified Mr. Slattery's attorneys that oral argument before the full 11-member court of appeals, sitting en banc, will be held at 9:30 a.m. on July 8th. This is much sooner than had been expected. A decision is anticipated within 90 days thereafter.

Updated March 19, 2010

The court of appeals has ordered further briefing and has agreed to hear the government's en banc appeal. It has directed the government to file its brief within 42 days. 28 days after that, Meritor is to file its brief with a response due by the government 14 days thereafter. A date will then be set for oral argument before all 11 circuit judges.

The issue on appeal is purely jurisdictional; whether the FDIC is a "non-appropriated funds instrumentality" or "NAFI". Both the trial court and the initial appeals court ruling found that as the full faith and credit of the United States stands behind the FDIC, it is not a NAFI and so suing the United States in the U.S. Court of Federal Claims is appropriate. If it were to be determined that the FDIC is a NAFI, the suit would be re-filed in the U.S. District Court, where the chances or obtaining the original $800 million in damages which Meritor had orignally sought would be much more likely as the law of restitution applies. Further, unlike an action brought against the United States in the Court of Claims, a lawsuit against the FDIC in district court allows for interest going back to the date of its first breach of contract against Meritor, which was in 1988. Thus, the FDIC could be exposed to 22 years of back interest on what could very well end up being a judgment significantly higher than the $276 million currently awarded.

For a full discussion of the NAFI issue, you should review the court of appeals decision which can be found under the September 30, 2009 update below.

Updated January 22, 2010

The court of appeals has asked Meritor to respond to the government's request for a re-hearing en banc. A copy of the response can be found here:

Meritor_Response_to_Appeals_Court_request

A decision by the court to either grant or deny the government's request is expected within 30 days.

Updated December 29, 2009

The government has filed a petition seeking a re-hearing or, in the alternative, a hearing before the full circuit court of appeals. The petition does not raise any issues which had not already been considered by the three-judge panel which heard Meritor's appeal and ruled in its favor. The court is under no obligation to grant the government's request, although it may do so. Whatever, the court traditionally announces its decision to accept or deny such requests within 30 to 60 days. A copy of the petition can be found by clicking on the following link:

Government_en_banc_petition.pdf

. In addition, for an interesting viewpoint on the main issue involved, paste the following link into your browser:

http://www.fincriadvisor.com/Templates/ArticlePage.aspx?DN=2eb8ebd9-8532-471b-878f-4255257d4fc6

Finally, paste http://www.banklawyersblog.com/3_bank_lawyers/2009/10/the-everyready-bunny-defendant.html for a discussion as to how the Meritor case relates to the current banking crisis and, specifically, how banks which have taken TARP money have decided that they cannot trust the government to keep its word.

Updated September 30, 2009

Yesterday, the Court of Appeals, in a 2-1 decision, affirmed judgment of $276 million against the government; reversed an additional $67 million in 'non-overlapping' damages which had previously been awarded by Judge Smith; reversed the dismissal on procedural grounds of certain Intervenor claims filed by a former shareholder, and remanded the case to Judge Smith 'for consideration of any remaining aspects of the final disposition of this 16-year proceeding'. The appeals court also ordered that the FDIC may not collect any of the deficit it incurred in liquidating the Meritor receivership from the $276 million awarded and further ordered that the amount be 'grossed up' by the amount of any taxes which might be claimed by the IRS against the Meritor estate as a result of the award. The government most likely will, however, appeal the ruling to the full en banc court of appeals, which could take up to another year. (The government must file its request within 45 days). However, the Court is not required to hear the appeal and, indeed, it only accepts about one en banc case a year. The full opinion can be found here:

Meritor_Court_of_Appeals_Decision.pdf

Updated June 3, 2009

ANOTHER YEAR GOES BY.

Today marks the one-year anniversary of the formal submission of the government's appeal and Meritor's cross-appeal to the U.S. Court of Federal Claims for the Federal Circuit. It was on June 3rd, 2008, that oral argument was held before a three-judge panel of the court in Washington, D.C. At this point we have absolutely no idea why it is taking so long, especially when you consider that decisions from the court of appeals in the vast majority of supervisory goodwill cases have been handed down within three to six months after oral argument. To illustrate, there was a decision just last week in a case in which oral argument had been held just this past February 3rd.

Judicial delays in this case are responsible for almost 10 of the 17 years in which Slattery v. the United States has been pending before the courts. During all of that time, Meritor shareholders have been patiently waiting for justice to be done -- without the benefit of any interest. To the contrary, the government has had the use of our money for free since it unlawfully seized and closed the beloved Philadelphia Savings Fund Society on December 11, 1992. At this point, the government could easily pay the full amount of the judgment against it just out of the interest it has earned on our money in the meantime. To be sure, the way the Meritor case has been handled thus far by the judicial system makes a mockery of the quotation from President Lincoln which is literally 'carved in stone' at the entrance to the U.S. Court of Federal Claims building in Washington:

"It is as much the duty of the government to render

prompt justice against itself, in favor of citizens,

as it is to administer the same between private individuals."

(Emphasis added).

In the meantime, don't bother writing your Congressman. Ever since the "Keating Five" scandal in the 1980's (which came back to haunt John McCain during his Presidential campaign), we can expect no help from our elected representatives. Assisting or meeting with constituents when the subject matter has anything to do with a lawsuit against the government is promptly leaked to the press by the (so-called) 'Justice' Department and portrayed as an attempt to interfere on behalf of fat-cat campaign contributors. (It does not matter that many Meritor shareholders are blue-collar people who received their stock by virtue of their having held passbook savings accounts at PSFS -- or, for that matter, by their children, who have been trying for years to close out their late parents' estates).

The only good news we have to report is that a decision could come literally at any moment. It will, of course, be of no help to the many, many shareholders who saw their investment in PSFS wiped out by the government's improper breach of contract and who died while waiting for justice to be done.

Updated December 3rd, 2008

Today marks exactly six months since oral arguments were held before the Court of Appeals and in most cases, the court announces its ruling within three to six months. Why they have not yet done so is a mystery, but Mr. Slattery's attorneys advise patience. One never knows the inside workings of a court, and reasons could range anywhere from a genuine dispute over an issue among the three judges to the simple fact that they could be short-staffed; or the clerk working on it quit for another job, etc. Again, there is just no way to know. So please be patient and be advised that when a decision is handed down, you will be notified via this page...

Updated June 1, 2008

The U.S. Court of Federal Claims has scheduled a hearing before a three judge panel for 10 a.m. on Tuesday, June 3rd. As is standard practice with the court, each party will be given 15 minutes to make its presentation, as well as a brief rebuttal period thereafter. The hearing should be over by about 11 a.m.

Mr. Slattery and his attorneys believe that we have a very strong case both on the facts and the law. With respect to the facts, the court of appeals may not overturn factual findings unless they were "clearly erroneous" or an abuse of discretion on the part of the judge. We have always been mildly concerned, of course, about the fact that many of the judges on the U.S. Court of Appeals for the Federal Circuit came to their positions after serving as government lawyers themselves. Nonetheless, we believe the court will be fair and will recognize that Slattery v. the United States has a unique set of facts and circumstances unlike any other Winstar case (If you have not already done so, we urge you to read the briefs below). Thus, we are hopeful that Judge Smith's rulings (with the exception, of course, of the restitution issue) will be found to have been correct. After 16 years of litigation, two trials (one on liability and the other on damages), and the millions and millions of legal fees which have been expended (thank you Mr. Slattery and everyone else who have helped pay the legal bills), hopefully we are nearing the end and justice may finally be done for the government's illegal seizure on December 11, 1992 of the oldest thrift institution in the nation, which had up until then survived for 176 years, our beloved PSFS.

A ruling from the court is expected in three to six months. For those wishing to attend the hearing, the court is located at 717 Madison Place, Washington, D.C. (across from the White House). Please be advised that WE WILL NOT BE OFFERING ANY COMMENTARY AFTER THE HEARING as we are well aware that the government's attorneys view this web site. You can next expect to hear from us when a decision is handed down.

Updated March 15, 2008

Mr. Slattery's final appellate brief has now been filed. (Actually, it was filed five days early). You can access it by clicking on the following link:

Slattery_March_10.pdf

We now await word from the court as to a hearing date before a three-judge panel. We will keep you posted when we have the date -- which will most likely be in late spring.

Updated February 13, 2008

We are advised that Mr. Slattery's final brief is not due until March 15th.

Updated February 1, 2008

Here is the government's final brief. Meritor's is due in 28 days, after which a date will be set for a hearing before a three-judge panel of the Court of Appeals.

Govt_Reply_Brief_Slattery_20080130.pdf

Updated January 23, 2008

We are advised that the government's brief is not due until January 30th.

Updated January 4, 2008 update

The government has been granted an extension to January 23 to file its brief.

Updated November 20, 2007

Mr. Slattery's attorneys filed their appeal brief late this afternoon. They are asking the court of appeals to increase the present award ($371 million) to $763 million in restitution damages. In addition, they are asking the court to award the interest earned by the government since Meritor's seizure on December 11, 1992. (Ironically, even if the interest is not awarded, it's clear that the government -- by its use of our money interest-free for the past 15 years -- will still have profited by the Meritor seizure -- even if the full $763 million is granted).

As you may know, restitution damages have generally not been awarded by the Court of Appeals in the Winstar cases. However, as Mr. Slattery's attorneys very carefully point out (beginning at page 49), the Meritor case has a number of unique features which distinguish it from all of the other S&L cases and they are hopeful that restitution will be ordered in this case.

We have been informed that PACER does not yet have the Slattery brief available for download. Therefore, we are making it available here at:

Slattery_appeal_Brief.pdf

More to follow . . .

Updated July 31, 2007

Late yesterday, the government filed its opening appellate brief. While we have not yet had the opportunity to read it, we are informed that it is basically a repetition of the various arguments which the government has been making for the past 15 years, starting with the assertion that there never was a contract betwen PSFS and the FDIC when PSFS agreed to acquire the ailing Western Savings Fund Society in 1982. Our response and cross-appeal is due on OCTOBER 22.

The government's brief is 64 pages, but with appendices, it is actually 147 pages -- far too much for our site to handle. Therefore, it is suggested that you go to

https://pacer.login.uscourts.gov/cgi-bin/login.pl?court_id=cafc where you will be able to open a PACER account and download all of the briefs as they come in and are posted on the court's web site. When logging in at the Court of Appeals website, NOTE THAT THE CASE NUMBER IS 2007-5063 and that if the Court has not yet posted a brief, check back with the site daily.

(Updated July 20, 2007)

The government has asked for, and been granted, a one-week extension for filing its brief. The brief is now due on July 30th.

(Updated June 7, 2007)

The government has been granted another extension of the date for filing its brief, this time for 45 days. (The last one was for 30 days). The reason given was that the Justice Department cannot file its brief until the Office of the Solicitor General approves, and the person assigned to the case is new and needs more time to get up to speed. THE BRIEF IS NOW DUE ON JULY 23 , which, of course, changes the schedule for the rest of the briefs accordingly.

Although we are advised that this sort of extension is routinely granted by the appeals court to the government, we cannot help but point out that based only upon the two extensions granted, the government has saved approximately $4 million, as -- unlike commercial litigants -- there is no interest accruing on the judgment. In other words, $4 million has been taken out of the pockets of Meritor shareholders and given to the rest of the country. Clearly this is unfair and those of you who are politically active should contact your elected officials and urge them to change the law so that the government be treated like any other commercial litigant when it comes to paying interest on judgments.

It goes without saying, of course, that the $371.7 million judgment awarded by Judge Smith in February of 2005 represents less than HALF of the actual amount of money lost by Meritor as a result of the government's misconduct. (We will be asking for the rest on appeal). However, using only the amount of the judgment, and applying the same 5 percent rate of interest which was used in the calculation above, the total savings to the government thus far since PSFS was improperly seized on December 11, 1992 comes to roughly $276 million.

The good news is that once the government does file its opening brief, the rest of the appeal operates on a rather strict calendar.

(Updated May 6, 2007)

Meritor has a new stock symbol. It is MSVP.

(Updated April 26, 2007)

As expected, the government has asked for, and received, an extension of time for filing its opening brief. The brief is now due on June 7th. All dates in the March 20th update below should thereby be moved out accordingly.

(Updated March 20, 2007)

Here is the tentative briefing schedule for the U.S. Court of Appeals for the Federal Circuit:

April 23 -- Government appeal brief due (Note: the government may ask for a 30-day delay, which would obviously set all dates back by 30 days).

June 4 - Meritor appeal brief due.

July 16 -- Government reply brief due.

July 30 -- Meritor reply brief due.

At this point, it appears that oral argument in front of a three-judge panel will take place in the fall. Typically, each side is limited to 30 minutes. A decision is usually handed down within six months of the oral arguments.

Finally, we once again want to advise everyone that this web site is no substitute for doing your own research. The various filings are a matter of public record and can be obtained from the Clerk of the Court's office, 717 Madison Place, Washington, D.C. 20005. Phone (202) 357-6400. This site is maintained by volunteers, and unless there are major developments, it may not be updated (as you have no doubt already noticed) for weeks or months at a time.

(Updated December 19, 2006)

Yesterday, Judge Smith denied the government's motion to reconsider, which means the case now moves into the appeals process. Although the case could be completed in as little as one year, we are cautioned by counsel to count on something more like 18 to 24 months. In response to our query as to a tentative timetable, here is what they provided:

"60 days for DOJ to notice its appeal, and 60 days after that to file its brief, but they invariably request and obtain 30 days extra to file their brief. What with all of the extensions, etc., we are probably looking at 18 months to two years to finish all the appeals."

At the same time, we will be cross-appealing on the issue of the additional $400 million in restitution which Judge Smith left open in his original opinion. Actual filing dates, etc., will be posted on the web site when they are made available.

Merry Christmas and Happy Hanukah!

(Updated October 11, 2006)

Late this afternoon, Judge Smith entered a Final Order certifying the Meritor case for appeal. In his order, Judge Smith included two specific provisions which had been requested by Mr. Slattery and his attorneys. First, the Order states that the $371,733,059 in damages may not be offset by any alleged "losses" which the FDIC claims it suffered as a result of its unlawful seizure of PSFS in 1992. Further, Judge Smith ordered that in order to "do justice", the damages are to be "grossed up" by the amount of taxes, if any, which might later be claimed by the IRS. (Needless to say, the government opposed both provisions).

At this point, the government has 10 days to ask the Court to reconsider its decision. Mr. Slattery's attorneys believe that such a motion, if made, will be swiftly denied. Also, both sides now have 60 days in which to file notices of appeal, after which a briefing and oral argument schedule will be set. The entire appeals process should take about one year -- although no promises can be made to that effect.

(Updated September 15, 2006)

A recent ruling by the U.S. Court of Appeals for the Federal Circuit in another Winstar case may help move the the Meritor case along. Unfortunately, there has been little progress on the tax issue thus far, as the government has requested more time (with no interest clock ticking, of course) because the IRS was recently flooded out of its Washington offices. The issue is, as you will recall, that Judge Smith wants to know what, if any, taxes might be claimed by the IRS so that he can "gross up" his original $371 million award by whatever that amount is. However, on August 28th, in LaSalle Talman Bank v. U.S. , the court of appeals upheld a much more streamlined process used by the judge in that case. There, the trial judge simply included a provision in his Final Order grossing up the original award ($147 million) by the standard corporate tax rate of 35 percent (to the extent that it applies) -- without the need for knowing the final and actual amount certain in advance. (The parties were directed to return with their calculations). For that reason, Mr. Slattery's attorneys will be asking Judge Smith's staff to see if that approach couldn't be used with the Meritor case as well. (In other words, the court would retain jurisdiction and "gross-up" the award at a later date -- should it become necessary). At present, the judge and his clerks are very busy with the Benj. Franklin case, but we are hopeful that he will shortly give this matter his attention so that a Final Order can be entered and the appeal process begin. Once that happens, each side has 60 days after the entry of the Final Order to file a notice of appeal. The appeals process itself takes about one year.

Finally, we once again want to advise everyone that this web site is no substitute for doing your own research. The various filings are a matter of public record and can be obtained from the Clerk of the Court's office, 717 Madison Place, Washington, D.C. 20005. Phone (202) 357-6400. This site is maintained by volunteers, and unless there are major developments, it may not be updated (as you have no doubt already noticed) for weeks or months at a time.

(Updated June 15, 2006)

A hearing was held in Judge Smith's courtroom this afternoon to deal with the proposed final order certifying the case for appeal. The main item on the agenda was Mr. Slattery's motion that the proposed order include a provision to 'gross up' the award in the event that it is later determined that the estate is subject to corporate taxes. In addition, the plaintiffs want to make sure that FDIC-Receiver does not use any of the money to pay interest which it claims it owes FDIC-Corporate. Judge Smith was clearly sympathethetic to both items and repeatedly stated that the intent of his ruling in February was that the damages award be distributed to Meritor's shareholders without being reduced by taxes or fees allegedly owed to the IRS or the FDIC and to do otherwise would not "make them whole". Indeed, the judge likened the government's position to telling the victim of an accident that while he is entitled to reimbursement for his damaged car, he will have to foot the hospital bill himself.

As expected, the government, of course, opposed both items and stated that it would take a great deal of time to determine whether any tax might be due and if so, how much. In response, Judge Smith stated that while 30 days might be too short, he certainly thought 90 days ought to be enough for the IRS and the tax division of the Department of Justice to come up with an answer. Accordingly, he directed Mr. Slattery's attorneys to provide a draft submission to that effect by Monday with the government having until July 7 to weigh in with their comments, whereupon the government will have 90 days to come up a number which Judge Smith will presumably then incorporate into his final order.

(Updated May 12, 2006)

A hearing will be held at 3 p.m. on Thursday June 15th in Washington to finalize the proposed form of Final Order certifying Judge Smith's February 10th Opinion for appeal. Judge Smith is expected to enter the Final Order at that time or shortly thereafter, whereupon each side will have 60 days to file notices of appeal with the U.S. Court of Appeals for the Federal Circuit. A briefing schedule and date for oral argument before a three-judge panel will then be set. As the Court of Appeals runs on a fairly strict schedule, the entire process should take about one year. The proposed form of Final Order submitted by Mr. Slattery's attorneys includes a "gross-up" provision protecting the damages award from any attempt by the IRS to tax the Meritor estate. (The government, of course, objects). A similar "gross-up" provision has already been upheld at the appeals court level in at least one other supervisory goodwill case. And regardless of whether or not Judge Smith agrees to add it to his Final Order, the Meritor receivership appears to have valid tax loss carryforwards which already exceed the amount of the judgment. Also on the agenda at the June 13 hearing will be the various housekeeping issues to which Judge Smith referred in his February opinion. Specifically, Judge Smith will hear arguments on three motions to intervene which have been pending since 1993, two by former employees and one by a former director, all of whom are looking to be cut in on the damages award. The FDIC, as Receiver, has opposed all three motions and it appears unlikely that they will be granted.

(Updated February 12, 2006)

INTERVIEW WITH FRANK SLATTERY

Q. So how are you feeling this morning?

A. Pretty darned good, actually. Justice has finally been done. People will never believe it, but it was never really about the money. It was about righting a terrible injustice which was done to PSFS, its many dedicated employees - and the people of Philadelphia, actually.

Q. Did you ever doubt that you would win?

A. No, but I must admit I never thought it would take this long! Actually, I knew we would win from the beginning because living through the whole experience as I did, I knew at the time that what these government bureaucrats were doing was just flat illegal. As we said in our pleadings, they were just more interested in protecting their budgets than in keeping their word.

Q. How about the amount of the award . . . what do you think?

A. I think it's a good start, but we actually did lose something like $800 million, and from reading the opinion, it seems that Judge Smith thinks we ought to be entitled to another $402 million, so I'm feeling pretty good today. I thought that what he had to say about how our case was different from all of the others was very powerful and I think it will be very positive for us in crafting our appeal.

Q. What happens next?

A. I'm going to be meeting with the lawyers next week and we'll see what they have to say. We have assumed all along that the government would appeal even if we had only been awarded ten dollars, so that will take about a year or so.

Q. What about interest on the money?

A. Unfortunately, that won't happen. In fact, the irony is that even if the government were ordered to pay us a billion dollars, it would still be making money, because it's had the use of the $800 million we saved them since 1982.

Q. Thank you.

(Updated February 10, 2006)

LATE THIS AFTERNOON, JUDGE SMITH'S LONG-AWAITED RULING ON DAMAGES WAS ISSUED. HE AWARDED A TOTAL OF $371.73 MILLION IN DAMAGES, WHICH WE BELIEVE EQUATES TO ROUGHLY $6.50 PER SHARE AFTER FEES AND EXPENSES (assuming that there are 54.6 million shares outstanding -- the actual number of shares may turn out to be considerably less). IT IS THE SECOND-LARGEST JUDGEMENT AWARDED OUT OF ALL 120 SUPERVISORY GOODWILL CASES. (The Glendale Federal award was only $10 million higher). MOST IMPORTANT, Judge Smith stated in unequivocable terms that the government clearly saved an additional $402 million ". . . and (also) retained the ever-accumulating interest (thereon) for more than 14 years". "If this were the first case in the Winstar line . . . (the Court) . . . would award this . . . (amount) . . . based upon the benefit conferred on the government." However, the "still evolving precedent in this area does not answer this question". While decling to formally award Meritor the additional restitution, Judge Smith effectively "kicked it upstairs", stating that "the parties (should) fully brief and argue the matter before . . . " the Court of Appeals. His Opinion can be accessed by clicking on the following link or pasting http://www.uscfc.uscourts.gov/Opinions/Smith/06/SMITH.Slattery.pdf into your browser.

Needless to say, we are very, very encouraged by -- and deeply thankful for -- Judge Smith's ruling and feel finally vindicated that the government has -- after all of these years -- been held accountable for its illegal seizure of the Philadelphia Savings Fund Society (PSFS), the oldest (and America's first) savings bank -- a respected and venerable Philadelphia institution which taught over five generations of working-class citizens (since the Presidency of James Madison) the value of thrift and saving -- and which, thanks to the Federal Deposit Insurance Corporation (which Judge Smith found was more interested in protecting its pocketbook than keeping its word) -- is no more.

WE OFFER OUR DEEPEST THANKS AND APPRECIATION TO FRANK SLATTERY -- the lead plaintiff who, instead of "rolling over" (as so many other S&L directors did in the face of overwhelming government pressure), not only said "I'm mad as hell and not going to take it any more", but also put millions of his own money on the line FIGHTING FOR ALL OF US. But for Mr. Slattery's unbelievable tenacity and courage, our stock would still be trading at the pennies per share that it did for quite a few years after PSFS was (to be quite frank) "stolen" by the FDIC. God bless you, Mr. Slattery.

Special thanks also go to the first-rate team of attorneys and counsellors from Winston & Strawn who put it all together: Lead Counsel Tom Buchanan (whose cross-examination skills are very, very lethal if you are not telling the truth); incredible advocates and brilliant wordsmiths Eric Bloom and Peter Dykema, and, also, the "human computer" who, quite often during trial testimony, was able to catch various (former) FDIC employees in numerous outright lies by recalling what they had said in depositions many, many years earlier -- the indefatiguable Lynn Spangenberg.

MORE TO FOLLOW -- INCLUDING (hopefully) AN INTERVIEW WITH MR. SLATTERY -- ON SUNDAY AFTERNOON.

(Updated November 14, 2005)

We're still here -- but, unfortunately, have nothing to report. We nonetheless are hopeful that a decision will be forthcoming before too much longer!

(Updated June 20, 2005)

We have been told by court personnel that the Meritor decision was a "top priority" and that it will be issued "hopefully" by the end of the summer.

(Updated February 4, 2005)

UNFORTUNATELY, THERE IS NOTHING TO REPORT. Our attorneys have been in contact with Judge Smith's law clerks, who report that . . . there is simply nothing to report. As you know, early last summer they reported that the Meritor verdict was next in line and that it would be rendered by year-end. Well, that obviously has not happened. As soon as there IS something to report, we will post it on the web site.

(Updated September 12, 2004)

AUTOMATIC E-MAIL ALERTS AND THE SHAREHOLDER SIGN-IN PAGE HAVE BEEN DISCONTINUED. This site is maintained by volunteers; we have no paid staff and we have been simply overwhelmed with incoming e-mails. In the future, when we obtain the name of a contact at the FDIC (which is not only the "wrongdoer", but also the Receiver of the Meritor estate), we will notify everyone so that you can direct your questions (about lost stock certificates, etc.,) directly to the Receiver.

A DECISION ON DAMAGES IS EXPECTED AT ANY TIME -- CERTAINLY BY YEAR END. Meritor's attorneys were informed early in the summer that there were two cases ahead of us and that the Meritor decision would follow them and be issued by year-end, at the very latest. On September 2, the other two decisons were released; the Meritor decision is next. It goes without saying, of course, that win-or-lose, we will post the decision here as soon as it is made available to us.

(Updated February 5, 2004)

Closing arguments were held in yesterday and went very well. Mr. Slattery and his attorneys were quite pleased, as were a number of shareholders who were present in the courtroom.

The case has now been formally "submitted" and it is hoped that Judge Smith will render his damages verdict by year-end. There can, however, be no assurance as to when he will rule. Stay tuned.

(Updated January 27, 2004)

Meritor has filed its supplemental response, which is the final briefing in the case. You can view it by going to the Frank P. Slattery v. the United States page, where all court filings are posted. Closing arguments are scheduled for 11 a.m. on February 4, 2004 at the U.S. Court of Federal Claims, 717 Madison Place, Washington, D.C., and are open to the public. Once closing arguments are finished, it will be up to the court to decide the amount of damages. We cannot estimate when the court will make its ruling, but expect that it will be at least several months, and hopefully by year-end.

(Updated January 5, 2004)

The government has filed its response to the plaintiff's post-trial brief, and, as expected, all answers to all questions end up with the same answer: zero damages. Although the court has already found that PSFS, the oldest thrift in the United States, was improperly seized and closed by the FDIC on December 11, 1992, the government insists that no one was harmed and that it should not have to pay even a penny in damages.

You can read the government's filings by going to the Frank P. Slattery v. the United States page, where all court filings are posted. Meritor will file its final brief on January 21.

(Updated November 24, 2003)

Attorneys for plaintiff Frank Slattery have filed their post-trial briefs as well as responses to 134 questions which Judge Smith has asked both sides to address as part of their briefing. Although the date for closing arguments remains unchanged (February 4, 2004), the briefing schedule between now and then has changed somewhat. The government's response is now due on December 29 (undoubtedly, their answers to the the judge's questions will all be the same: whatever it takes to get to zero damages) with the plaintiff's reply to the government's response due January 21.

To view the pleadings, go to the Frank P. Slattery v. the United States page, where all court filings are posted.

(Updated September 2, 2003)

Government 'expert' witness has much of his report thrown out; hearing will be held as to the admissability of a second government 'expert' witness; dates set for post-trial briefing and closing arguments

As you know, a hearing was held last week to deal with certain post-trial matters. Among the issues was whether or not the reports and testimony of two of the government's 'expert' witnesses should be disallowed and stricken from the record. As it turns out, the government in this case -- as it has done in many others -- has been offering so-called 'expert' testimony from people who, as it turns out, are not really 'experts' in the area in which they purport to testify.

Based upon his earlier rulings during the liability phase of the trial, the Court reconfirmed that one of the government's 'expert' witnesses did not, in fact, possess sufficient banking experience and expertise to testify as an expert on banking issues, which will likely result in the Court's ruling that a large portion of his report is either inadmissable or entitled to little weight. The government will be given an opportunity to request Judge Smith's reconsideration of this ruling with respect to specific portions of the report. As to a second government witness, Judge Smith will allow the plaintiff's attorneys to file a formal brief by September 30, with the government responding by October 14. Oral argument on the motion is to be held on October 29, with Judge Smith promising a decision "shortly thereafter".

To be honest -- and despite the fact that he has scheduled briefing and oral argument -- we will be surprised should Judge Smith decide to throw out this particular government witness' testimony. That having been said, however, we note that while a judge in another case also did not grant a similar motion, she made it quite clear that the government witness in question is, in fact, no 'expert' at all -- and she decided that his testimony (for which the government has paid many millions of our tax dollars) should be given very little weight. Specifically, in Westfed Holdings, Inc. v. the United States, Judge Emily Hewitt had this to say about the government's so-called 'expert':

"In an attempt to qualify Dr. (name withheld) as an expert, the government . . . argued that (he) satisfied the liberal standards . . . for admission . . . (However), the Court disagrees . . . an expert's testimony must be both relevant and reliable in order to be admitted as evidence."

Worse, Judge Hewitt also found that there were direct conflicts between the testimony of this particular government 'expert' witness and other of the government's own witnesses in the same case and that "this discrepancy goes to the reliability and usefullness of Dr. (name withheld)'s testimony."

The briefing schedule is as follows:

- November 4, 2003: Plaintiff's post-trial brief

- December 11, 2003; Defendant's response brief

- January 7, 2004; Plaintiff's reply to defendant's reponse

- February 4, 2004; closing arguments, Washington, D.C.

We are hopeful for a ruling within three to six months thereafter.

(Updated July 29. 2003)

Trial on damages concludes

The damages phase of Frank P. Slattery, et al., v. the United States, which began on July 7, ended today with both sides concluding with short rebuttal presentations. As Mr. Slattery alluded to in his July 18 interview (see below), the plaintiff's attorneys and their expert witnesses believe that they put on a very solid case for damages. Judge Smith stated that he will hold a status conference to deal with various post-trial matters (i.e., introduction of exhibits, etc.) on August 28th. As that time, a schedule for post-trial briefing will also be set. POST-TRIAL BRIEFS, WHEN FILED, WILL BE POSTED ON THIS SITE.

(Updated July 18. 2003)

Q. Mr. Slattery, can you tell us how the trial is going and where it stands?

A. "The trial is about two-thirds of the way through. We have finished putting on our case and the government is now putting on theirs. We feel pretty good about our case."

Q. "What are we talking about in terms of damages?

A. "There are a number of damages models which our expert witnesses have put forth. First, they estimate reliance damages at $495 million for actual cash losses incurred in operating the Western deposit franchise. And that shouldn't be too difficult to understand when you consider that after assuming the insolvent Western Savings Bank's assets and liabilities in 1982, PSFS was earning income on $1.2 billion of Western's assets, but paying out interest on $2.1 billion to Western's depositors -- deposits, of course, are liabilities -- and that this inverse relationship went on like that until PSFS was seized 10 years later.

"In addition, there are expectancy damages based upon the value of Meritor on certain dates. We feel that we are entitled to the value of Meritor on August 1, 1988 - the day before what the court last year found was the government's first breach. Dr. Finnerty, one of our expert witnesses, puts that at $170 million plus a control premium which brings you up to about $260 million. Alternatively, Dr. Finnerty values the bank on the day it was seized at $112 million -- it's our position, of course, that by that time, the bank's value had already been severely damaged by the government's breaches. Dr. Finnerty also calculates $28 million in “wounded bank” damages, primarily consisting of transaction costs in connection with various assets which we maintain were sold because of the government's breaches. So if you add up $495 million in actual cash losses on Western, plus $28 million in transaction costs plus just the severely diminished value on December 11, 1992 of $112 million, it comes to roughly $640 million."

Q. Anything else?

A. "Another approach is restitution damages. We have a 1982 press release from the FDIC in which it stated that by not having to close Western Savings - that is, by getting PSFS to take it over instead - the government saved $696 million. We believe the government should give up that money. Further, by not having to pay out $696 million in 1982, the FDIC was able to invest that money and in the over 20 years since then, we calculate that it would have earned something like $2.1 billion. It's our position that the FDIC must give up that money as well. Whether or not the court will agree, of course, is another story. It is important to note that some of the various damages claims have overlapping aspects and that you cannot just add up all of the numbers. Think of it as a 'menu' from which the judge will decide."

Q. So much for your experts: what does the government say?

A. "Whatever it takes to get to zero."

Q. Pardon me?

A. "Whatever it takes to get to zero -- seriously. The government is arguing that every one of our damages claims is so fatally flawed that the judge should award us nothing. I guess they figure that no one was harmed when they seized PSFS and put it out of business."

Q. What is the trial schedule?

A. "The trial is scheduled to end on July 29th. After that, there will be post-trial briefs and counter-briefs filed by both sides. That will take about 60 days. I would guess that about 30 days after that would be oral arguments and then the case would be officially submitted to the judge for his consideration."

Q. And a decision?

A. "That's anyone's guess, but I'm hoping for the end of this year."

Q. Thank you.

(Updated July 5, 2003)

Trial on damages begins Monday, July 7 at 10 a.m.

Opening arguments in the damages phase of Frank P. Slattery, Jr., et al., v. the United States are set to begin at 10 a.m. on July 7th in the National Courts Building located at 717 Madison Place, Washington DC. The trial is open to the public and is expected to be held on most weekdays through July 31. Unlike the trial on liability, which took four and one-half months, the damages trial is expected to last only three weeks, with a ruling expected by year-end.

To be frank, the trial will probably be quite boring, as the main issues involve arcane accounting matters and "dueling experts" (i.e., "expert" witnesses) which/who would probably put most people to sleep. If you wish to attend the trial, the opening arguments on July 7 (perhaps extending into the morning of July 8) will probably give you a good sample of what the rest of the trial will be like. Likewise, the closing arguments at the end of the trial. Also, within 30 to 60 days after the trial ends, both sides will likely submit post-trial briefs to the court. They will be an excellent resource for those following the trial and will be posted on this site when they are filed.

Unless there are major developments, we will not be updating the site until after the trial has ended.

Trial on damages July 7 - 31 (Updated January 3, 2003)

The time between now and then will be taken up by further discovery and pre-trial motions. Expect no further updates until there is something new to report. This site is maintained free of charge by volunteers. We do not have the time to update the site merely because someone wants to know 'what's new?'

Automatic e-mail alerts

have been temporarily suspended. Since our victory in court in August, the shareholder sign-in page has been overwhelmed with new registrants. Since we have no staff, we are running behind in entering all of the new names into our automatic e-mail update list. If you did not receive an automatic e-mail notifying you as to this update, that is why. Please be patient while we work through the backlog. In the meantime, check the web site periodically for updates.

Lost Stock Certificates

We have received numerous inquiries from shareholders who cannot locate their stock certificates. Oftentimes, these are children and grandchildren of people who were stockholders of Meritor and/or depositors at PSFS. If your stock is/was held in "street" name, there generally should be no problem tracking it through the brokerage firm which holds or held the stock -- you should contact the brokerage firm directly. (Also, if you actually have a certificate, KEEP IT IN A SAFE PLACE as there currently is no transfer agent). If you cannot locate your certificate you will, unfortunately, have to deal with the FDIC, which is the receiver of the Meritor estate. (The same folks who, as the court has now found, breached its contract with Meritor and improperly seized PSFS and sold it to Mellon Bank). We are attempting to get a name and phone number of the right person at the FDIC for you to contact and will post it here on the website when we have it.

Judge Smith Finds Government in Breach of Contract (Updated August 14, 2002)

Late this afternoon, Judge Smith handed down his ruling in Slattery v. the United States. WE COULD NOT BE MORE ENCOURAGED BY HIS VERDICT He found that a) Meritor had a contract with the government; b) the government deliberately breached the contract, and c) as a result,Meritor and its shareholders suffered damages. (The ruling should be available sometime tomorrow at www.uscfc.uscourts.gov/2002.htm).

The schedule going forward is as follows:

1. Judge Smith has ordered attorneys for both sides to appear before him within 60 days to arrange the schedule for either summary judgment motions and/or a trial to determine the amount of damages. The parties have previously agreed that if there is to be a trial on damages, it should start within six months of today's ruling. While there can be no assurance, we believe that the damages phase of our case will proceed much more expeditiously than has the liability phase.

2. In the meantime, Judge Smith has ordered briefing within 30 days on the subject of whether or not he should also consider, as an alternative to a damages remedy for breach-of-contract, one based on an unconstitutional "taking" of private property. This could be significant. Unlike a routine contract breach where even post-judgment interest is prohibited by law, Judge Smith specifically pointed out in his ruling that victims of unconstitutional "takings" are legally entitled to interest from the date of the "taking". In addition, Judge Smith has specifically expressed, in other cases, his frustration with the government's being able to use other people's money, interest free, calling it "unjust". Nonetheless, because of federal securities laws, we will not be making any damages estimates on this web site. We will, however, make available, when they are filed, the legal briefs setting forth Meritor's damages claims.

Finally, we offer, on behalf of all of PSFS's former employees, depositors and shareholders, our sincerest and most profound thanks to Frank Slattery, the lead plaintiff in Slattery v. United States. But for Mr. Slattery's tenacity and commitment ("I'm mad as hell and I'm and not going to take it any more") -- to say nothing of his willingness to fund the the very high costs of the Meritor lawsuit out of his own pocket -- the government would have gotten away with its unlawful seizure of PSFS and its shareholders would have been left without any recourse. His lonely and thankless 10-year battle for justice has provided hope for all of us. THANK YOU MR. SLATTERY!

(Last updated June 11, 2002 at 8:11 p.m. EST)

With the 90 days in which Judge Smith promised a decision having come and gone, and with this coming Friday, June 14, marking the second anniversary of the conclusion of the trial of Slattery v. the United States, our attorneys had a conversation with Judge Smith's clerk who assured them that a) Judge Smith is actively working on it and b) issuing his opinion is presently the judge's "top priority".

It appears that Judge Smith is not discriminating against us, as a number of his decisions in other cases have taken two years or more to hand down. In addition, although Judge Smith went on "senior" status shortly after the Meritor trial ended, he has continued to take on a heavy caseload and has issued opinions in 12 cases since that time. (He also teaches law school at night). We continue to have faith that Judge Smith will do the right thing and urge your continued patience. PLEASE DO NOT CALL THE COURT -- we will let you know as soon as we hear anything.

(Last updated April 2, 2002 at 7:22 a.m. EST)

We were up most of the night thoroughly analyzing in detail yesterday's ruling from Judge Smith awarding $35 million in the Suess/Ben Franklin case. After review, we remain convinced that properly crafted and narrowly drawn, the door remains open for a damages award for Meritor based upon the $800 million ($15 per share) which it paid out to the former depositors of Western Savings. (This presumes, of course, that we receive a favorable ruling from Judge Smith on the liability issue, a decision which he has promised by June 1). The approach our attorneys will need to take is not that we are seeking a windfall (unlike most of the other thrifts, we have never been looking for "expectancy" damages), but that we simply want our $800 million back. In addition, we are confident that the facts and circumstances of our case differ considerably from the issues which Judge Smith faced in BENJ. Indeed, we have said from Day One (December 11, 1992) that the Meritor case differs from all of the other 120 supervisory goodwill cases.

Analyzing Judge Smith's decision, it is clear that he settled on awarding only the market value of BENJ stock on the day before its supervisory goodwill was breached because he felt all other damage options had been foreclosed to him. Indeed, he clearly stated his discomfort with handing down such a meager award, commenting:

" . . . the Court understands, of course, that the award of $35 million for the value of a franchise seized 12 years ago provides Franklin with far less in economic terms than it is owed . . .the Court believes that the award is grossly inadequate in view of the damages actually suffered by Franklin". (Emphasis added).

BENJ asked for over $900 million in "expectancy" damages; i.e., it wanted to recover what its expert witnesses felt the bank would have been worth had it been allowed to operate until 1998 (when the damages trial began) and then sold at that time with a change-of-control premium. Judge Smith simply couldn't buy all of the "what-if" assumptions which must necessarily go into such an estimate. Accordingly, he felt that awarding expectancy damages would have been unduly speculative.

Judge Smith made clear that he would have preferred a restitution remedy, but that that option had also been foreclosed to him by the Court of Appeals ruling in the GlenFed case. You will recall that in that case, Judge Smith actually awarded over $900 million, only to be told by the Court of Appeals that awarding damages under a "reliance" theory would more "finely tune" the amount of actual damages.

As for "reliance" damages, this is where it gets interesting. Judge Smith addressed this remedy only in a footnote. He found that since BENJ had not originally sought damages under a "reliance" theory (the BENJ damages trial was conducted prior to the Court of Appeals ruling in the GlenFed case), he was precluded from now awarding them. He also noted that even were he able to do so, since the components were the same as a restitution claim, he still would not be able to award them. Hence, he had nothing left to go on except the $35 million.

We have believed all along that seeking "expectancy" damages simply won't work. However, the Court of Appeals in GlenFed made clear that actual damages suffered (i.e., the $800 million paid by PSFS to Western's depositors -- less offsets for Western assets later sold at a profit) as a result of the government's broken promises (i.e., that Meritor/PSFS would be allowed to count its supervisory goodwill as capital for 15 years) is fully recoverable as "reliance" damages.

Lastly, BENJ involved a seized thrift which suffered from one, discrete "breach"; i.e., the enactment in 1989 of FIRREA, in which Congress specifically prohibited the inclusion of supervisory goodwill when counting minimum capital ratios. (As you will recall, Meritor was regulated by the FDIC, not the FSLIC, and thus was unaffected by FIRREA). Unlike, BENJ, our attorneys demonstrated at trial that for years before Congress got involved, Meritor had been the victim of an egregious and pernicious pattern of breaches of its 1982 agreement with the FDIC -- almost before the ink on the paper was dry. For instance, there were breaches by the FDIC in 1983 and 1985 -- long before FIRREA was even thought of. Further, in 1988 -- a year before FIRREA, the FDIC threatened to seize Meritor if it did not agree to a minimum capital ratio significantly higher than any other bank in the country -- its way of "counting" Meritor's goodwill -- without really counting it. As a result, Meritor was forced to sell 54 of its most profitable branches to Mellon -- losing an extremely valuable stream of future profits -- in order to comply with the artifically high capital ratios which the FDIC extorted. Then, no sooner had Meritor achieved the onerous new capital ratios, the FDIC again imposed even higher ratios in 1991 (all the while claiming in public, of course, that they were really counting Meritor's supervisory goodwill as capital when confidential FDIC documents produced at the trial proved otherwise).

It gets worse. When it imposed the even-more-onerous 1991 capital ratios, the FDIC specifically agreed that were Congress to do to FDIC-insured banks what it had done to FSLIC thrifts (i.e., restrict supervisory goodwill similar to as did FIRREA), the FDIC would renegotiate the artifically high capital ratios. However, when Congress then enacted FDICIA in 1991, it allowed the FDIC itself to make the call as to whether or not supervisory goodwill would count as capital for FDIC-insured banks such as Meritor. Instead of re-negotiating the ratios, as they had promised Meritor they would do, the FDIC deliberately avoided telling Meritor for months that it was no longer going to count its goodwill -- not delivering the notification until just minutes before the bank was seized -- so that Meritor could not sue to enforce the terms of its 1982 agreement with the FDIC.

There are just too many breaches to go into at the moment (see the post-trial briefs for further details), but perhaps the most vicious and deceitful breach was at the very end. After December 19, 1992, FDICIA took away the power of the state banking commissioners to close banks and gave the authority to the FDIC. However, the new powers for the FDIC came with new rights for the banks, which were entitled to a formal hearing process, etc., which would have delayed the seizaure well into 1993. With the Pennsylvania banking commissioner having gotten what is described as "cold feet" at the last minute, and eager to seize Meritor before its fiscal year ended (we'll talk about restitution damages in a moment), the FDIC deliberately began proceedings to terminate Meritor's deposit insurance -- again in breach of the 1982 agreement -- so as to create a run on the bank and force the commissioner's hand. To sum up, what happened to Meritor was not the "plain vanilla" breach that happened to the rest of the thrifts.

(Last updated March 22, 2002 at 8:57 p.m. EST)

We normally don't comment on other goodwill cases, but yesterday's decision by Judge Bohdan A. Futey of the U.S. Court of Federal Claims awarding $132 million -- albeit begrudgingly -- in the Bluebonnet Savings case bears mention. In the 13 years that the supervisory goodwill cases have been languishing in the U.S. Court of Federal Claims (80% of whose judges formerly represented the government as lawyers), this is the first time that any of the judges (with the exception, of course, of Judge Smith -- also, we point out in the interest of fairness, a former government lawyer), has awarded a meaningful amount of money to the victims of what is perhaps the most stupendous "bait-and-switch" scheme in history . Even so, Judge Futey issued his ruling only after having been basically ordered to do so by his superiors on the U.S. Court of Appeals for the Federal Circuit. Astonishingly, he had earlier issued a 49-page opinion finding the government guilty but, nonetheless, still managed to find a way to award zero damages. God bless the Court of Appeals!

One of the reasons why the government has not been willing to even discuss settling any of these cases is because -- as evidenced by the Bluebonnet case -- judges have been making mistakes in its favor! Indeed, the U.S. Department of Justice has openly bragged in letters to congressmen and senators that (up until now) the awards granted against it have been for only pennies on the dollar (with the exception of Judge Smith's award of over $900 million in the GlenFed case -- which the appeals court subsequently sent back with instructions to re-formulate using an alternative damages theory). The Bluebonnet award changes all that. There the plaintiffs sought $136 million and have now been awarded $132 million. It appears that the government will finally have to write its first $100+ million check. However, since there is no interest clock ticking, you can be sure that the U.S. Department of "Justice" will drag Bluebonnet on as long as it can before justice is done -- just as it did in Mobil Oil v. United States, in which DOJ ignored a ruling from the U.S. Supreme Court for over a year before finally writing a $156 million check (20 years later -- with no interest).

(Last updated February 20, 2001 at 8:06 p.m. EST)

JUDGE SMITH PROMISES DECISION IN 90 DAYS

We attended a hearing this afternoon on the subject of the government's motion to remove jurisdiction from the Court of Claims on the basis that the FDIC is a "non-appropriated funds instrumentality" ("NAFI"). (See Sept. 10 update below). As you may recall, this motion has been outstanding for over a year now and it is thought that in finally scheduling a hearing, the court was signaling that it was clearing the decks for its final verdict.

Even if we could somehow predict how Judge Smith will rule on the NAFI motion, we would not be so bold as to do so. Suffice to say, however, that we were pleased by his line of questioning. More important, we had a conversation with a court official in the hallway before the hearing began and the court official was quite emphatic that the Slattery/Meritor case was a "top priority" and would be decided in the spring. Even more encouraging, at the end of the hearing, Judge Smith himself stated in open court that he will rule on the motion AND hand down the trial verdict simultaneously within 60 to 90 days. He also stated that his decision in the Suess/Ben Franklin case will come "shortly", which he later defined as "within 30 days". While there have, in the past, been other "predictions" by court personnel as to when our case would be ruled upon, we are encouraged by the fact that this is the first time that Judge Smith himself has promised a deadline. He acknowledged that both cases had "gone on far too long".

(Last updated January 15, 2002 at 9:06 p.m. EST)

SPRING RULING EXPECTED

Judge Smith's new law clerk told the lawyers for both sides today that the judge expects to rule on "liability" in the spring. Between now and then, oral argument on the motion to dismiss which the government filed about a year ago (its fifth - see September 10 update below) will be accommodated on February 20 at 3 p.m. That Judge Smith has finally scheduled oral argument we take as a good sign, indicating that he is now at the stage of tying up loose ends and clearing the deck for his ruling. Presuming that Judge Smith denies the government's motion (he has denied four previous dispositive motions), a verdict could be handed down as early a month or so later, i.e., March 21, the first day of spring. (Don't forget, though, that spring lasts until June 20th!)

(Last updated December 7, 2001 at 8:38 a.m. EST)

As you will recall, Ben Franklin Savings is the case in front of ours on Judge Smith's "to-do" list. Don Willner, the attorney for Ben Franklin, has some insightful comments and advice on their website, which is located at www.benfranklinoregon.org. With respect to not sending letters to Judge Smith, we couldn't agree more. PLEASE DO NOT CONTACT THE COURT.

Believe it or not, we are told by numerous attorneys that delays of two years between the ending of a "bench" trial and the issuance of a ruling by the judge is not -- contrary to what many people have believed -- uncommon. In addition, we are told by court sources that instead of reducing his case load -- to which he is entitled now that he has taken Senior Judge status -- Judge Smith has taken on even more work. The good news, however, is that we believe that we are getting closer to a decision date and will communicate it to you as soon as we know what it is.

(Last updated on October 19, 2001 at 11:18 p.m. EST)

We received a voicemail early this evening from the court official who told us on October 11 that an announcement as to decision dates for the Suess and Slattery cases was to have been made by today. He stated that the dates were still being worked on and that when they are set, the lawyers involved in the cases will be told first. (Although the earlier information had not been given to us in confidence, it seems court protocol may have been breached somewhat by his giving us information before the attorneys). Mr. Slattery's attorneys will be speaking directly with the court next week in an effort to firm up a date. We will post you immediately upon learning what it is.

(Last updated on October 11, 2001 at 8:15 p.m. EST)

We were advised this afternoon by a court official that by October 19, the court will announce "dates certain" upon which the Suess (Ben Franklin) and Slattery (Meritor) opinions will be released. The court spokesman told us that the Suess case will definitely be first, with Slattery "shortly thereafter". The spokesman also said that the verdicts will come "not much longer" after the dates are announced, "three to six weeks would be my guess". That would give us an "outside" date of November 30th, but we should know the actual date by next Friday.

Stay tuned.

(Last updated on October 7, 2001 at 6:36 p.m. EST)

We still don't know what is holding up Judge Smith's verdict, but as to the case ahead of us in the queue, Suess v. United States, he may have been waiting for a ruling from the Court of Appeals. Just handed down in Bluebonnet Savings Bank, FSB v. United States, the U.S. Court of Appeals for the Federal Circuit reversed a lower court judge's ruling awarding zero damages on the basis that Bluebonnet had not proved the harm done to it with "reasonable certainty". Confirming that "expectation" damages (over and above actual damages), can, in fact, be awarded against the United States, the Appeals Court sent the case back to the trial judge "with instructions to formulate an appropriate award . . . of damages". More important, the unanimous ruling from the three-judge panel made clear to all of the judges hearing the supervisory goodwill lawsuits that "the ascertainment of damages is not an exact science, and where responsibility for damage is clear, it is not essential that the amount thereof be ascertainable with absolute exactness or mathematical precision". Also, "it is not the duty of the courts to second-guess the terms of a bargained-for exchange."

There is no question that Meritor was damaged, because the oldest thrift franchise in the nation was wiped out by the government on December 11, 1992. If we are fortunate enough to receive a positive ruling from Judge Smith as to the issue of the government's liability for breach of contract, we will be seeking actual as well as "expectancy" damages.

To review the Bluebonnet ruling, click here. Also, the plaintiffs in the Suess case (Ben Franklin Savings of Portland, Oregon, which, like Meritor, was seized and put out of business) have commentary as well at www.benfranklinoregon.org.

(Last updated on September 10, 2001 at 10:35 p.m. EST)

We are thoroughly perplexed as to why Judge Smith has still not handed down his ruling not only in our case, but in the Suess/Ben Franklin case as well. In a conference call held on August 8th, a court spokesman told the attorneys that Judge Smith was planning to have the Suess case decided "by the end of the month". That deadline has come and gone and we are now in mid-September without word. The Suess case is first in line (waiting 17 months); our case is second (going on 15 months), and GlenFed is third (90 days). As far as we know, these are the only major cases on Judge Smith's docket; indeed, he has issued only one opinion that we know of in over a year (a military pay case). It is very, very frustrating. Especially so when you consider that the clerk who worked with Judge Smith during the Slattery trial has now left for a private law firm and, according to our lawyers, most probably finished drafting the opinion some time ago for Judge Smith's final touches and approval. (For what it's worth, the clerk is now working for one of the large law firms representing thrifts with goodwill lawsuits against the government; obviously he will be recusing himself)

Our lawyers believe that Judge Smith will ultimately deny the government's motion and will render his verdict before too much longer. (If he really wanted to be rid of our case, he could have simply granted the government's motion a long time ago and saved himself and his clerks a lot of work.) However, while we would dearly like to see Judge Smith simply "sh-- or get off the pot", the "what-if" scenario of having our case heard in front of a Philadelphia jury is intriguing, for it might actually streamline the proceedings and offers a number of benefits. 1). Presuming that Judge Smith rules in our favor on liability (the evidence, as you can see for yourselves by reading the post-trial briefs, is simply overwhelming), we still must have another trial in front of him next year anyway -- to assess damages. If we were to go to Philadelphia, on the other hand, both liability AND damages would be tried together, so the timing would be about the same (or even, given Judge Smith's pace, less; needless to say, juries don't take 17 months to come in with a verdict). 2). Pre-judgment interest against the United States is prohibited in the Claims Court. Freed of that constraint, we would seek pre-judgment interest going back to December 11, 1992. 3). Damages would be paid not by the U.S. taxpayer, but by the FDIC, which currently has a surplus of nearly $30 billion on hand. 5). Finally, it frees up our case from the other 120 pending supervisory goodwill cases.

All that having been said, it probably won't happen. Judge Smith has a lot of time and effort invested in this case himself. We just wish he'd hand down his verdict.

(Last updated on July 22, 2001 at 7:15 p.m. EST)

On July 17, Mellon Bank announced that it was getting out of the retail banking business, selling all 345 of its branches to Citizens Financial Group, Inc., a unit of the Royal Bank of Scotland. We believe that up to 25% of those branches are former PSFS branches. For $13.4 billion in deposits, Citizens will pay Mellon $2 billion in cash, which represents a 16 percent premium. That percentage is more than double what Mellon paid when it acquired a total of 81 PSFS branches holding $7.7 billion in deposits in 1988 and 1992.

There is no question but that Mellon's acquisitions of PSFS branches helped put it into the position to sell its retail banking operations at what is clearly a stunningly attractive price. Some history is in order:

Before the FDIC dramatically raised PSFS's minimum capital ratios in 1988 (well above those of banks which did not have any supervisory goodwill on their books), PSFS was the largest and oldest bank in Philadelphia and was number one in terms of market share. Mellon had only recently entered the Philadelphia market via its purchase of the Girard Bank -- having theretofore been confined largely to the Pittsburgh market. The sale of 54 of PSFS's choice suburban branches in 1988 -- forced upon Meritor in order to comply with the FDIC's increased capital demands at the time -- dramatically increased Mellon's presence in southeastern Pennsylvania. But what really put Mellon on the map was the seizure of PSFS on December 11, 1992 by the FDIC. In acquiring PSFS's remaining 27 branches, Mellon was instantly catapulted into first place, dominating market share in Philadelphia and its suburbs to this day. Over the years, Mellon officials have repeatedly boasted in the press and trade publications about what a profitable move its acquisition of PSFS branches became. And if any further proof is needed, one need only look to the Mellon/Citizens press release.

We do not know whatever became of the 81 PSFS branches and the $7.7 billion in mostly stable, low-cost deposits which were acquired by Mellon. However, counsel to Mr. Slattery will be sending a letter to both Mellon and Citizens demanding that they retain and safeguard all records relating to these branches for use in the event that we receive a favorable ruling on liability from Judge Smith and are thus able to proceed to a trial on damages.

Judge Smith held a three-hour hearing this afternoon to listen to arguments from attorneys for Glendale Federal Savings and the government as to how he should adjust his $909 million damages award to GlenFed in light of the Federal Circuit's ruling last February that instead of focusing on restitution, he should use a "reliance" remedy instead. GlenFed argued that even under "reliance", they are still entitled to $862 million in damages. The government -- as it has done and continues to do in all 120 supervisory goodwill lawsuits (including Meritor/PSFS and Ben Franklin, which were seized and put out of business), argued that the damages are zero because no harm was done. (Honest!)

At the conclusion of the hearing, Judge Smith told the assembled attorneys that while he expected to rule as expeditiously as possible, there are two other pending cases which he intends to get out first. He identified them as Suess v. the United States (Ben Franklin Savings, Portland, Oregon) and Slattery v. the United States (Meritor/PSFS).

Both Suess and Slattery have been waiting for a ruling from Judge Smith for over one year now. Hopefully, we will be hearing something before too much longer.

(Last updated on June 14, 2001 at 10:50 p.m. EST)

It has been exactly one year since the Slattery/Meritor case was submitted to Judge Smith for a verdict. We have no idea when Judge Smith will issue his decision, but we hope that it will be soon. While we are obviously disappointed in how long it is taking him to rule, we remind our fellow shareholders that thanks to the Court of Appeals decision in the GlenFed case, Judge Smith has a "full plate" at the present time. We are confident that while it perhaps will take longer than most of us would like, Judge Smith will eventually "do the right thing".

(Be even more patient than you have been).

(Last updated on April 4, 2001 at 3:30 p.m. EST)

COURT OF APPEALS RULES THAT THRIFTS ARE ENTITLED TO SUE FOR EXPECTANCY DAMAGES; REVERSES JUDGE HODGES' APRIL '99 FINDING TO THE CONTRARY IN THE CALFED CASE.

(Updated February 19, 2001 at 9:10 p.m.)

COURT OF APPEALS HOLDS THAT SUPERVISORY GOODWILL HAD "SUBSTANTIAL VALUE"; DIRECTS JUDGE SMITH TO RECONFIGURE HIS DAMAGES AWARD IN THE GLENFED CASE; URGES THE PARTIES TO SETTLE.

2. Commentary from the Association.

While we will make every effort to keep you up to date with respect to new developments with respect to the Meritor case, WE URGE YOU TO CONSULT WITH COUNSEL AND CONDUCT YOUR OWN INDEPENDENT RESEARCH.